- Tesla’s stock plunged 33.7% in nine days after the market wiped out $82.1 billion of the firm’s market cap in a single day.

- Analysts expected the pullback, especially after Tesla’s $5 billion equity distribution on September 1.

- Speculation around a stock buyback is emerging as the electric carmaker has cash from the distribution.

Tesla stock has several vital catalysts that could fuel its recovery in the fourth quarter. After an immense 33.7% fall in nine days, speculation about a potential stock buyback is growing.

Tesla Stock Pullback Is Not a Surprise, But What Happens From Here?

Tesla’s correction after a 479% year-to-date rally is not a surprise.

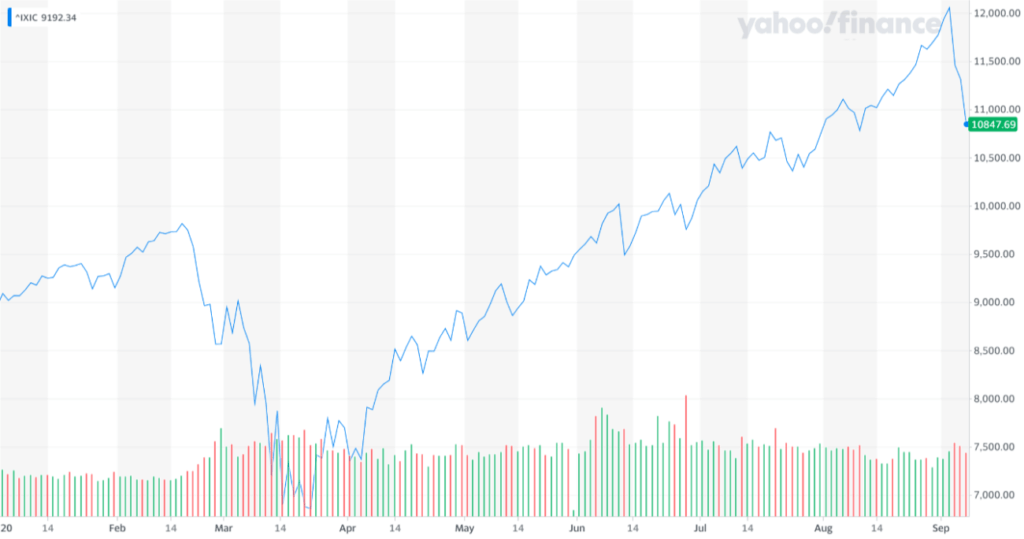

The Nasdaq plunged after reports claimed SoftBank CEO Masayoshi Son was the so-called “Nasdaq whale.” The Japanese conglomerate’s $4 billion options bet on U.S. stocks rattled investors, contributing to a selloff.

The Nasdaq entered into a technical correction on Tuesday. | Source: Yahoo Finance

Key tech stocks, including Tesla and Apple, fell in tandem as the U.S. stock market slumped.

But in the near term, analysts anticipate a sharp recovery backed by strong fundamentals.

Despite short-term challenges, Tesla’s S&P 500 inclusion is expected in the future. The company is also preparing for its highly-touted Battery Day, in which analysts expect announcements of significant battery capacity improvements.

Atop the fundamental catalysts, Tesla said it would sell about $5 billion worth of TSLA stock on September 1.

In a filing with the U.S. Securities and Exchange Commission (SEC), Tesla said it would sell shares ‘at-market’ prices.

It’s unclear at what time frame the company sold the shares and if it sold all $5 billion. That frees up to $5 billion in cash, which could potentially lead to a buyback. Although Tesla probably won’t purchase shares with the capital it secured in its $5 billion sale, it could tap into its cash reserves to initiate a buyback–especially if the stock price keeps falling.

Tesla said it would use the net proceeds of the sale to “strengthen” the balance sheet and for “general corporate purposes.”

Following the TSLA stock sale, the company is in a better position to buy back stocks.

The TSLA stock price year-to-date. | Source: Yahoo Finance

Given the intensity of the stock pullback, a buyback program could become compelling.

Strategists Saw the Exact Scenario Coming

Matt Maley, the chief market strategist at Miller Tabak, warned about the TSLA stock after the $5 billion equity distribution.

Maley noted that investors who buy TSLA stock after the distribution “are going to get burned.”

Strategists say the tech selloff marks the beginning of a new short-term trend. Watch the video below:

[embedded content]

Since September 1, which was when Tesla announced the distribution, TSLA stock has fallen by nearly a third. That’s in line with Maley’s previous call:

Even if this stock rallies a bit more over the next week or two, it’s going to be trading at least 30% below today’s level before the end of the year, in our opinion.

The combination of strong fundamental factors, an expected post-distribution trend, and the possibility of buybacks buoy the near-term bull case of Tesla.

As Welt’s market analyst Holger Zschaepitz said, Tesla lost around $82.1 billion worth of market cap overnight:

Tesla stock tanks 21% in worst one-day loss on record, erasing $82.1bn of market cap after GM’s Nikola stake, S&P snub amidst tech rout.

After such a large drop within ten days, the probability of another massive correction remains low.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com.