- APPL stock might head into an optimistic year in 2021 as analysts anticipate a general increase in smartphone sales.

- Analyst SK Kim said he expects Samsung stock to rise by 40% in 2021 due to recovering smartphone, TV, and chip sales.

- The analyst says the slump of Huawei in Europe could boost Samsung, and it could also fuel the demand for the iPhone.

Daiwa Capital Markets analyst SK Kim expects the Samsung stock price to rise 40% in 2021 with high smartphone sales. The overall increase in smartphone demand could further boost APPL stock, which faces an optimistic “supercycle.”

Apple was the only major smartphone manufacturer in the first half of 2020 to avoid a substantial decline in sales.

Heading into the fourth quarter, analysts expect iPhone sales to sharply increase, particularly in China.

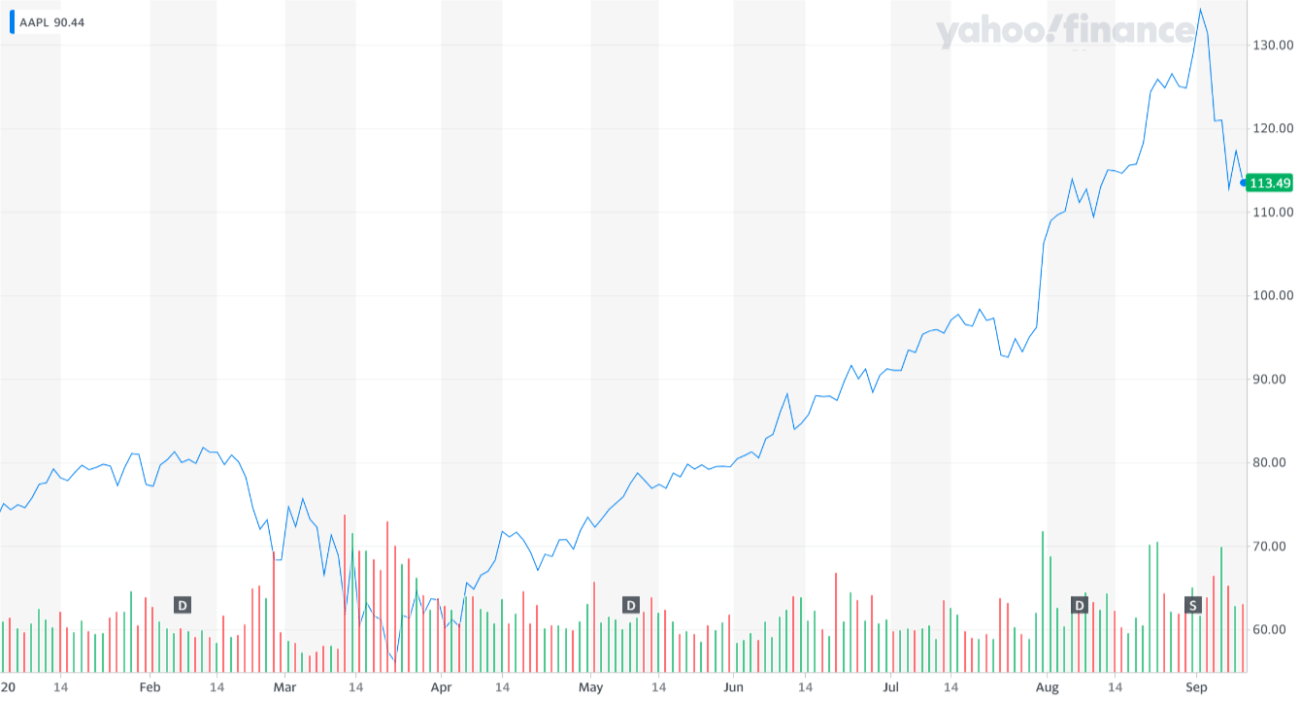

The year-to-date performance of APPL stock. | Source: Yahoo Finance

APPL stock, which declined by 15.42% since September 1, could consequently see newfound momentum in the coming months.

Smartphone Sector to Rebound: Joy For APPL Stock and Investors

According to Kim, Samsung might see “strong earning upside” in Q3 and throughout 2021.

He said:

“We see multiple catalysts for SEC in 2021 on opportunities from 5G, memory, and foundry, which should drive a rebound in its share price, in our view.”

Kim anticipates Samsung to sell 79 million smartphones and expects a short-term stock rebound.

In comparison, Apple requested the production of an additional 75 million 5G iPhones. Since Apple could ship a similar number of phones, it buoys APPL stock’s near-term bull case.

In Q3, the analyst said that TV sales could “drive robust earnings upside” for Samsung. For Apple, Macbook, iPad, and AirPod sales have remained strong throughout 2020.

Analysts are also attributing the struggles of Huawei to boost the bull scenario for Samsung stock. Theoretically, it should have the same optimistic effect on APPL stock, given its strong presence in Europe.

The iPhone market share in Europe declined by 17% to 14.1% throughout 2019 in Europe. While Apple shipped 6.4 million phones in 2019 Q2, Samsung sold 18.3 million phones in the same period.

But as the technology research firm Canalys said, many of Samsung’s sales came from its more affordable A models. Meanwhile, Apple has continued to sell its flagship models, which are more expensive with a higher mark-up.

The year-to-date performance of Samsung Electronics. | Source: Yahoo Finance

Considering the discrepancy in the models’ prices, the slump of Huawei in Europe could also strengthen APPL stock. CLSA analyst Sanjeev Rana said:

“It seems Samsung is benefitting from Huawei’s woes in Europe and Latam and anti-China sentiment in India.”

Variables That Could Further Catalyze Apple in 2021

A persistent theme around the bullish projections of APPL stock in the medium term is the imminent supercycle.

Wedbush analyst Daniel Ives has continuously emphasized since late August that 350 million iPhones face an upgrade opportunity.

Analysts discuss the bull case for APPL stock in the medium term. Watch the video below.

[embedded content]

The iPhone 12 launch coincides with the upgrade season. The growing popularity of the iPhone SE could further catalyze Apple’s performance in the smartphone sector. Ives said:

“350 million of 950 million iPhones worldwide are in an upgrade opportunity. I view iPhone 12 as a once-in-a-generation opportunity in terms of the upgrade cycle.”

The confluence of the general increase in smartphone demand and tech conglomerates’ strong performances could positively affect Apple heading into 2021.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.