- Nikola just became America’s third-biggest car company.

- It’s more than just a fairytale success story.

- Nikola has never actually delivered a single vehicle.

Thomas Edison might have won the public relations battle during the 19th and 20th centuries, but Nikola Tesla is quickly winning the war for the new millennium.

The Serbian-American inventor can now boast that he’s the namesake of not one, but two of America’s three biggest automakers.

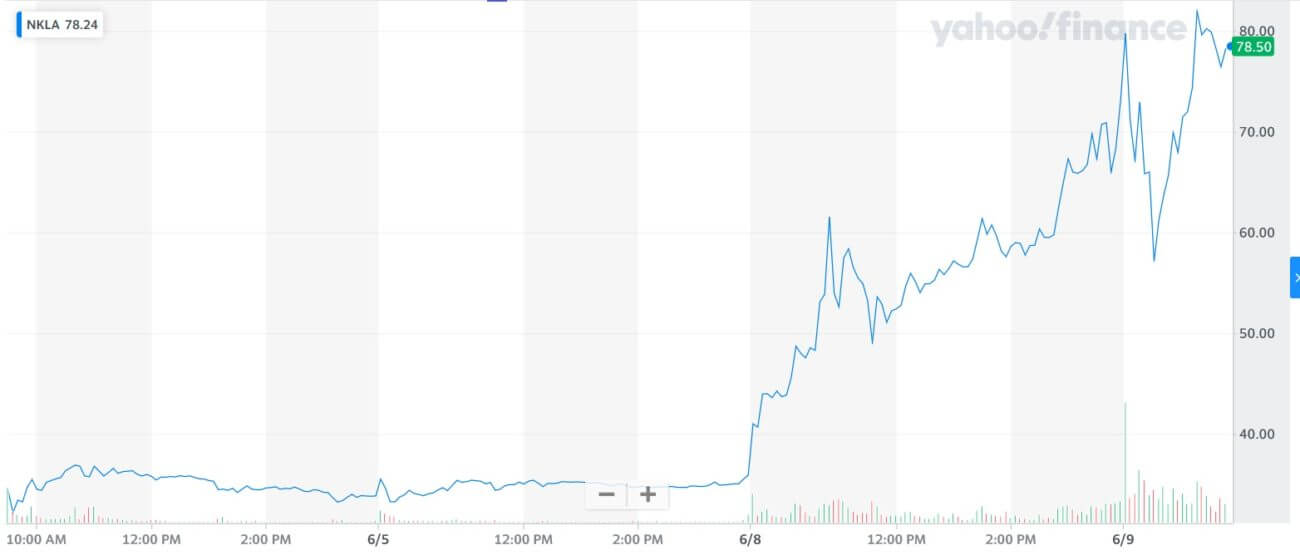

Tesla Motors has long been well-known. But after a meteoric post-IPO rally, Nikola Corporation (Nasdaq: NKLA) is worth more than either Ford or Fiat Chrysler.

Shares of Nikola have more than doubled in the last five trading days, making a parabolic move higher. | Source: Yahoo Finance

The Nikola Saga So Far

Nikola stock has gone parabolic since its Nasdaq debut, and the company has become a story-driven darling.

NKLA shares first started trading under their current ticker following a reverse merger with VectoIQ. That was a special purpose acquisition company run by Stephen Girsky, a former vice-chair of General Motors.

Nikola’s reverse merger raised $700 million for the startup EV firm. That’s in addition to the new ticker symbol – and a market cap large enough to trade on the Nasdaq.

The company has just started taking preorders on a fuel cell-powered truck, also known as the Nikola Badger. That appeared to heighten the NKLA rally, even though they might not even build it.

And that’s just about the entire story. The company has zero revenue to speak of. But it expects to launch its first vehicle in 2021, rapidly scaling up revenue to $1 billion annually in 2023. By 2027, they expect to be producing 30,000 fuel trucks per year.

Markets Continue to Reward EV Firms Over Traditional Automakers

That’s in contrast to automotive leader Ford Motor Company, which currently has about $115 billion in annual revenues.

While there are a lot of differences between the high-tech startup and the 117-year old king of carmakers, there’s one huge similarity. Their market cap.

The massive surge in Nikola shares has sent the valuation of the company to over $29 billion. Again, that’s with no revenues and no product yet.

After a rocky start to the year, Ford is worth slightly less than the upstart Nikola. | Source: Yahoo Finance

Ford, an industry leader for a century, is valued around that same level. But without an attractive story to sell starry-eyed investors, a company making revenue just isn’t as compelling of a trade.

Time will tell if traders cool on the Nikola story. After all, investors have been attracted to companies that have seen revenue declines of more than 50 percent and face bankruptcy.

Heck, they’ve even more than doubled the value of companies that have already declared bankruptcy.

But traders forget that automotive sales in the U.S. cooled last year, including those for electric vehicles.

Electric vehicle sales slid in 2019 compared to 2018, even as new models continued hitting the marketplace. | Source: Greencarcongress.com

Nikola Stock’s Meteoric Surge Is Ripe for a Sell-Off

Is there a great story behind Nikola? Absolutely.

And for those who feel like they missed out on last year’s killer run in Tesla Motors, this looks a lot like a second chance.

Then again, parabolic moves like this one from Nikola stock are rarely sustainable.

Those chasing a speculative name already at a market cap higher than a proven industry leader are likely to be disappointed before being rewarded.

It’s a good thing Nikola Tesla’s middle name – if he even had one – is a mystery. Because if it wasn’t, some cynical business executive would have already made it the namesake for another unimpressive electric car company.

And chances are, the same investors would be piling tens of billions of dollars into its stock right now.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the stocks mentioned.

This article was edited by Josiah Wilmoth for CCN.com.

Last modified: June 9, 2020 5:57 PM UTC