- Nikola shares fell by nearly 30% on Monday.

- Founder Trevor Milton resigned abruptly late Sunday as the executive chairman.

- The new energy automaker is battling fraud allegations that have seen federal authorities launch investigations.

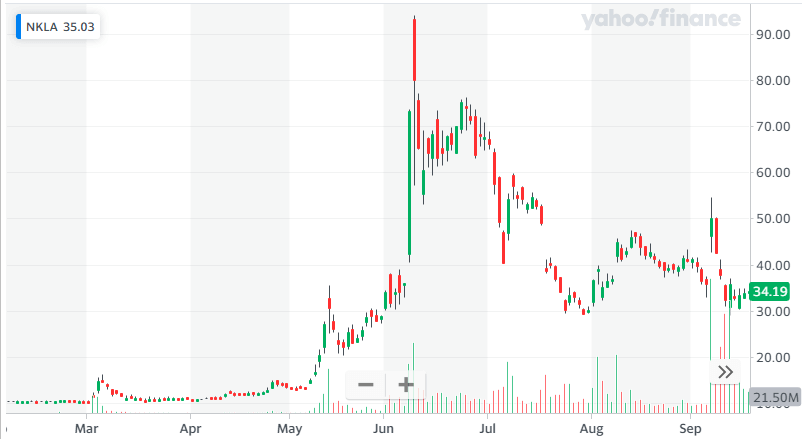

Shares of new energy truck maker Nikola tanked by as much as 30% on Monday.

After closing Friday at $34.19, Nikola’s stock bottomed at $24.05 on Monday–a new low.

NKLA has fallen sharply following the resignation of its executive chairman and founder Trevor Milton. | Source: Yahoo Finance

Nikola’s stock collapse comes after founder Trevor Milton resigned as executive chairman. The chairman’s position now goes to Nikola board member and former General Motors vice-chairman, Stephen Girsky.

The Nikola founder is the company’s largest shareholder, with 91.6 million shares. As of Friday’s close, the stake was valued at around $3.2 billion. Milton’s holdings have lost nearly $1 billion in value since Friday.

Why Is Nikola Collapsing?

The resignation comes less than a fortnight since short-seller Hindenburg Research accused Milton of misleading investors by making multiple false assertions regarding Nikola’s technology.

The short-seller accused Nikola of being an “intricate fraud.”

One of the false statements regarding its technology included claiming to have a working prototype of a hydrogen fuel truck. Nikola went on to release a video showing the truck moving downhill. In reality, it was a truck rolling down a hill with no propulsion of its own. Soon after the allegations came out, Nikola admitted the deception.

Some of Nikola’s deceptions are just coming to light. | Source: @Printers_ally/Twitter

Now federal authorities are involved with the Justice Department and the Securities and Exchange Commission investigating the firm.

Will Nikola Pass the “Prove Me” Test?

Even for the bulls, Nikola is regularly described as a “prove me” stock. Unfortunately for Nikola, it is proving the critics right and the optimists wrong.

The company’s biggest asset, and now its most significant liability, has been Trevor Milton. The Nikola founder’s showmanship skills and hunger for publicity gave the company a larger-than-life profile. For instance, Nikola initially painted itself as possessing a vibrant research and development department that would provide serious competition to rivals such as Rivian and Tesla.

This is now seriously in doubt since its recent partnerships suggest Nikola possesses no ground-breaking proprietary technology.

Earlier this month, Nikola entered into a deal that would see it use General Motors’ technology. This includes GM’s Hydrotec fuel cell technology and Ultium battery system, with Nikola contributing no intellectual property of its own other than the body design of the vehicles.

Nikola is not only outsourcing manufacturing but key technology as well. | Source: @vinjovanovic/Twitter

Besides GM, Nikola additionally outsourced key battery technology for its prototype electric trucks. According to the Financial Times, Nikola relies on technology supplied by Romeo Power Technology months after touting its proprietary “game-changing” battery tech.

Damage Has Been Done

The resignation of Milton will no doubt remove a distraction that comes from the founder’s controversies. But the damage has been done.

Cowen analyst Jeffrey Osborne recently described Milton as “boastful and always in ‘sales mode.’” Osborne said it would take Nikola’s top leadership time to “regain credibility with investors.”

The analyst is overly optimistic. Nikola already blew its chance with investors.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.

Sam Bourgi edited this article for CCN.com. If you see a breach of our Code of Ethics or find a factual, spelling, or grammar error, please contact us.