- 2020 is almost here and Tesla’s robo-taxis are MIA.

- Insiders have been dumping stocks hand over fists with Elon Musk being the only significant buyer.

- Falling R&D spending means robo-taxis will definitely not hit the markets in 2020.

It has been roughly seven months since Elon Musk spearheaded a $2.7 billion capital raise at Tesla (NASDAQ:TSLA) based on the claim that the company will have 1 million robo-taxis on the road by 2020. Musk also asserted that the technology will make Tesla cars an appreciating asset.

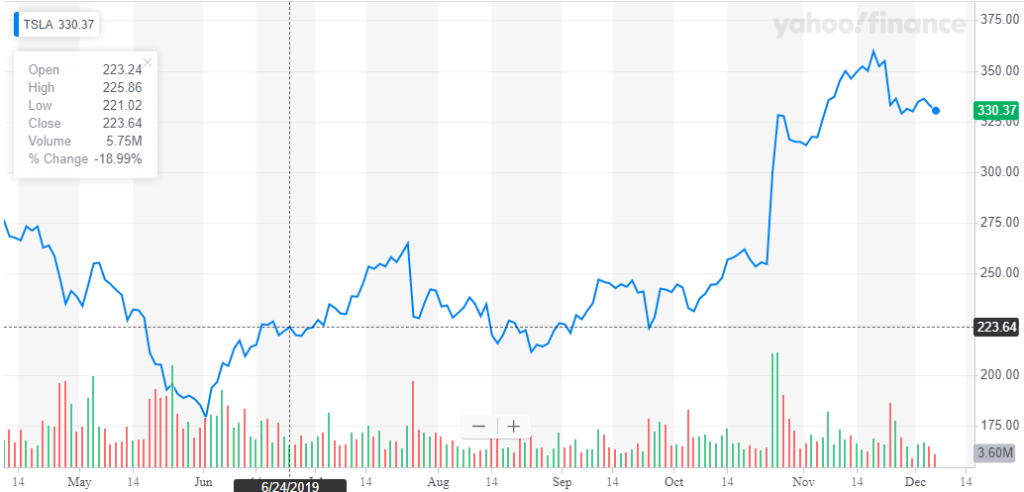

Although there were no impediments to Musk raising money based on such outlandish promises, the markets didn’t buy it as shares fell roughly 30% in the subsequent weeks. Share prices have since rebounded on the back of surprise Q3 profit, a Shanghai Gigafactory and cost-cutting.

Tesla has been very volatile over the last seven months. | Source: Yahoo! Finance

Tesla has been very volatile over the last seven months. | Source: Yahoo! Finance

Insiders Not Buying into the Robo-Taxi Hype

Most experts agree that fully self-driving cars are decades away from coming to fruition. Elon Musk, on the other hand, has repeatedly said that Tesla will have a million robo-taxis on road by the end of 2020. Given the disparity between the two projections, Tesla will definitely attain an unassailable lead in the self-driving car market if Musk’s forecast is accurate.

The total addressable market for autonomous vehicles is projected to hit $7 trillion per year by 2050. And since no other company claims it is close to solving the autonomous driving dilemma, Tesla will establish a near-monopolistic lead in this multi-trillion market if Musk delivers.

Tesla insiders are not as optimistic as Musk. The trading activity of the board members suggests that they don’t buy into the robo-taxi hype as they have been dumping stock hand over fist.

Last month, Tesla board member and Elon’s brother Kimbal Musk conveniently dumped over 64,000 shares, just days after announcing the Cybertruck launch on his Twitter.

Kimbal Musk unloads shares after announcing the Cybertruck. | Source: Twitter

Kimbal Musk unloads shares after announcing the Cybertruck. | Source: Twitter

Then just yesterday, Tesla President Jerome Guillen honored the stock-dumping tradition as he exercised options expiring in 2024 and sold 2,000 shares.

Tesla President doesn’t want to hold long-term stock options.| Source: SEC

Tesla President doesn’t want to hold long-term stock options.| Source: SEC

In fact, over the last 12 months, Tesla insiders excluding Elon Musk have bought a meager 1,360 shares whereas the total sales have amounted to nearly $119 million in value.

Insiders have been eager to sell. | Source: Secform4.com

Insiders have been eager to sell. | Source: Secform4.com

Rampant stock selling and exercising of long-term options indicates that Tesla insiders don’t believe Musk’s claims.

Tesla’s R&D Spending Tells the True Story

Tesla has been pulling all sorts of levers to report surprise profits. Unfortunately for Elon Musk cultists, one of those levers is slashing the research and development spending. Apart from the robo-taxis that Musk has promised, Tesla also has two cars lined up for release: the Model Y and Cybertruck.

Solving the autonomous vehicles puzzle and launching new cars will require billions of dollars in R&D overheads. For instance, Tesla’s annual R&D expense jumped 65% in 2017 to $1.4 billion as compared to 2016 when it was working on just the Model 3.

Now with two cars and a completely autonomous-vehicle project in the pipeline, you’d expect the R&D expenses to be well over $5 billion. For the 12 months ending September 30, 2019, Tesla’s R&D spending was down 4.85% year-over-year to a paltry $334 million.

Judging by this, there’s zero chance Tesla will have even a single robo-taxi on the road in 2020, let alone a million. It’s no surprise that the insiders are not buying into the hype and are dumping stock.

This article was edited by Sam Bourgi.