- The TSLA stock price has increased by 27.08% in the past week, as investors anticipate the battery technology day.

- A BloombergNEF analyst said Tesla’s battery technology might be three to five years ahead of the competition.

- Tesla is already the most dominant company in the electric car market and superior technology strengthens its bull case.

TSLA stock surged by 12.58% on September 14 as investors anticipate the battery technology day on September 22. Analysts say Tesla would soon be three to five years ahead of the competition in the battery market.

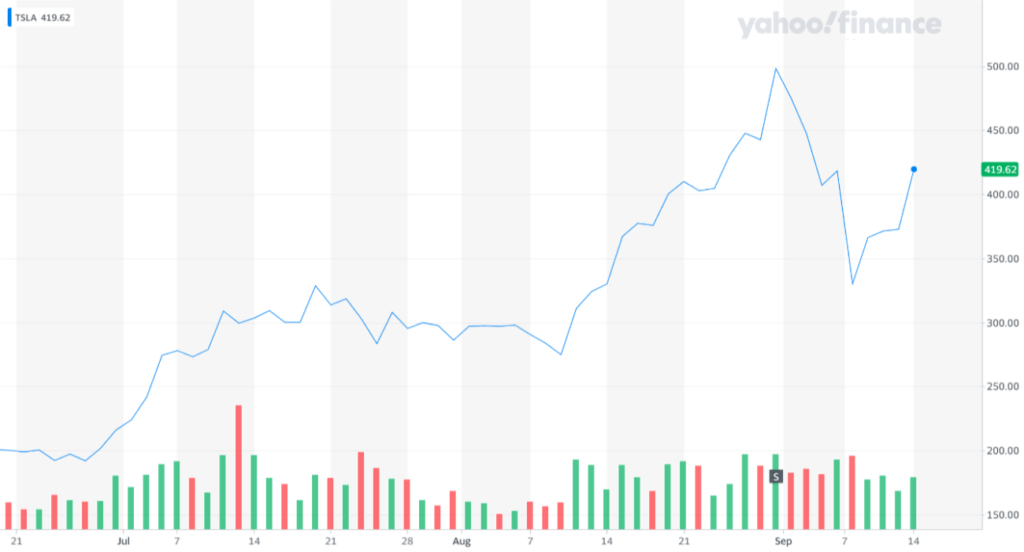

In the past week, the TSLA stock price climbed from $330.21 to $419.62, recording a 27.08% increase. The stock price is now down by 15.79% from its peak at $498.32.

The 3-month performance of TSLA stock. | Source: Yahoo Finance

Analysts and Battery Experts Optimistic About Tesla and TSLA Stock

According to Steve LeVine, Medium’s editor at large, battery experts believe Tesla would soon distance itself from its competitors.

On the battery technology day, LeVine expects Tesla CEO Elon Musk to announce cost parity between Teslas and combustion vehicles.

If achieved, the cost parity would allow Tesla users to avoid paying a “large premium over gasoline-driven models.” It would also act as a significant catalyst for TSLA stock in the longer term.

Musk’s major announcement on the battery technology day still remains uncertain. But if it is about the cost parity, LeVine emphasized he “may rattle the whole of the auto industry.”

Investors in the stock market appear to be taking the chances that Musk would shock the automotive industry.

The TSLA stock price steeply fell in tandem with most tech stocks during the recent U.S. stock market correction.

The 3-month trend of the Nasdaq composite showing its recent pullback. | Source: Yahoo Finance

The stock price has started to gain newfound momentum since September 8. Technically, it solidified the $328 level as a support area, reaffirming the stock’s bullish trend.

The optimism around the battery technology day has been a strong positive factor for the near-term performance of TSLA stock. In the years ahead, it could strengthen Tesla’s dominance in both the traditional auto industry and the electric car market.

Speaking to LeVine, the renewable energy research group BloombergNEF’s head of energy storage James Frith praised the growth of Tesla’s technology.

Frith said that Tesla has come to a position where other carmakers are playing catch up. He said:

“We are at the point where carmakers are just about catching up to where Tesla is now. And now Tesla will move ahead again, and they will need another three to five years to catch up.”

The thought that Tesla is three to five years ahead of the competition while remaining as the overwhelmingly dominant electric vehicle company is frightening.

For newly-emerging electric car companies, Frith suggested it could cause significant problems.

Tesla has an abundance of infrastructure, supply chains, and Gigafactories that allow the company to reach massive production capacity.

As CCN.com previously reported, Tesla’s two Gigafactories in Shanghai and California alone could manufacture 700,000 vehicles per year.

The confluence of the company’s well-built infrastructure and superior technology buoys the long-term bull case of TSLA stock.

Strategists say TSLA stock should not be viewed as a conventional car manufacturer. Watch the video below:

[embedded content]

Would Wall Street Stop Betting Against Tesla?

Analysts have said that Wall Street prefers newcomers in the electric car market because they want growth.

AutoTrends Consulting analyst Joe Philippi said “what Wall Street wants is growth,” referring to electric vehicle manufacturers.

But researchers say that Tesla might be too far ahead of the pack by now. LeVine said Tesla is essentially “rendering rival electric vehicles obsolete just as their makers are getting started.”

Disclaimer: This article reflects the author’s opinion and should not be considered investment or trading advice from CCN.com. The author holds no investment position in the above-mentioned securities.