- It just got 95% cheaper to “reserve” a Tesla vehicle in China.

- The electric carmaker already cut prices on its Chinese-made Model 3 to qualify for government subsidies.

- Demand for Tesla’s cars may not be as strong as previously thought, according to one analyst.

It’s just become a whole lot easier to pretend like you own a Tesla. If you live in China, that is.

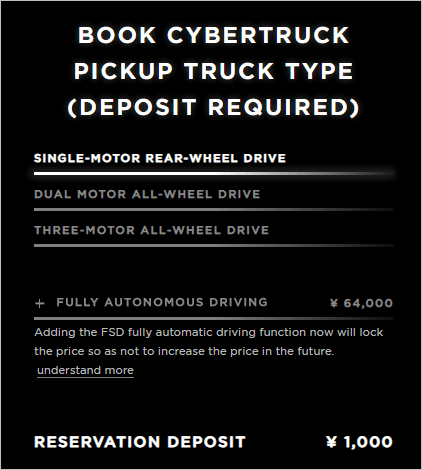

The electric carmaker slashed the reservation fee for its sedans and SUVs in China by a staggering 95%. New buyers must only pay a 1,000 yuan ($142.85) deposit, down from as much as 20,000 yuan ($2,857) previously.

There is one caveat. The deposit will no longer be refundable. So unlike before, placing a reservation on a vehicle you don’t actually intend to purchase is going to cost you.

A uniform reservation deposit applies to all cars sold by Tesla China. | Source: Tesla.cn Website

Trouble for Tesla in China?

Tesla delivered its first Chinese-made Model 3 in December last year. In March, Tesla reportedly manufactured 10,158 units of its best-selling car at its Shanghai Gigafactory.

The Chinese market has proved to be highly price-sensitive, though. The Elon Musk-led carmaker has already had to adjust its strategy on multiple occasions.

During June, Tesla China reported a 35% month-on-month increase in Model 3 sales.

The downside is that this sales spike only occurred after the automaker reduced prices on the base model vehicle below 300,000 yuan – the cutoff for government subsidies.

Is Elon Musk underpricing to hit delivery targets?

Tesla’s price pressures in China could be even worse than most investors realize.

Just this week, rumors broke that the long-range Model 3 is listed for sale as cheap as $36,000.

Reports have emerged of Tesla aggressively discounting the Model 3 in China – possibly to hit delivery targets. | Source: @globaltimesnews/Twitter

The long-range version of the Model 3 sells for just under $47,000 in the U.S. when you exclude potential incentives and gas savings.

GLJ Research analyst Gordon Johnson believes Tesla is deliberately sacrificing its gross margins to hit delivery targets.

[O]ur opinion here is simple; TSLA engaged in a discounted fleet sale (the magnitude of which remains unknown – i.e., was it 5K cars, 10K car, or more/less) in June to hit [its] delivery numbers in China…

Still, investors seem unperturbed by the news. The stock is up by about 50% since late June. And it’s showing no signs of slowing down.

TSLA rallied more than 5% in after-market trading on Wednesday after a surprise second-quarter profit.

Last modified: July 22, 2020 9:37 PM UTC