- American, Delta, and United are all eliminating cancellation or change fees.

- The fees constitute a significant portion of the revenues of most major airlines.

- Last year, Delta generated close to $1 billion in change fees.

In air travel, the Covid-19 pandemic has shifted the balance of power from the airlines to the passengers.

American Airlines (NASDAQ:AAL), Delta Air Lines (NYSE:DAL), and United Airlines (NASDAQ:UAL) demonstrated that this week when they announced they would be dropping the fees associated with canceling or changing a flight.

The three airlines are following the example set by Southwest Airlines (NYSE:LUV), which has never charged change fees.

The elimination of the change fee, temporarily or otherwise, is an indication of the dire straits airlines are facing. These fees are not insignificant, and in ordinary times, they wouldn’t just give up such a huge revenue source.

Delta Air Lines to Be Hardest Hit By New Change Fee Policy

In 2019, Delta generated over $830 million in change fees, United earned $625 million, and American generated $818 million.

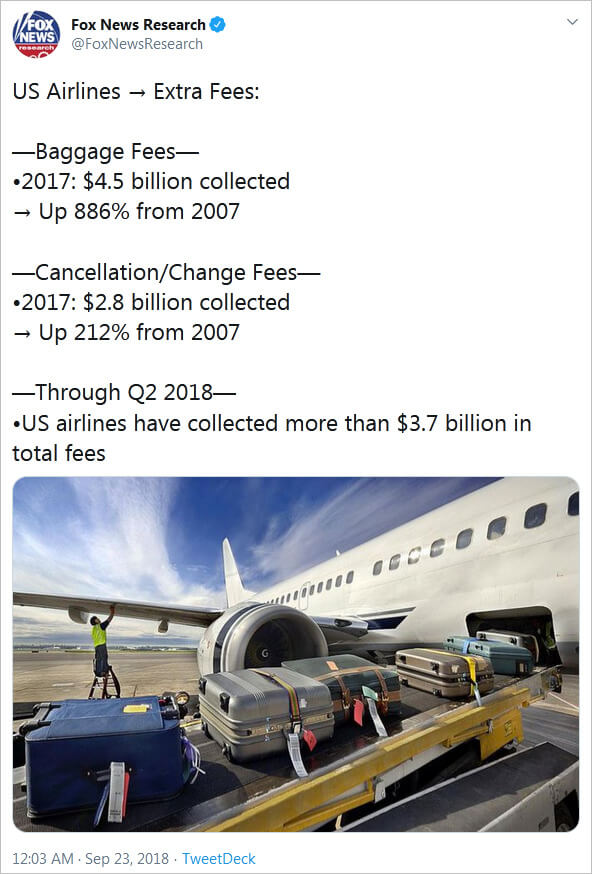

The U.S. air travel industry took in $2.8 billion in change fees last year, the same amount that was collected in 2017.

Last year the U.S. air travel industry collected $2.8 billion in change fees. | Source: @FoxNewsResearch/Twitter

The move, though, will do little to plug the massive revenue and cash holes airlines are facing.

A “W”-Shaped Air Travel Revival

After a drastic decline in passenger traffic between March and May, the numbers slowly improved during the summer. Now the situation is reversing, though not drastically, as autumn approaches.

According to the Transportation Security Administration, the best day for travel in the post-lockdown era was August 16, when the travel numbers reached 862,949 passengers.

After recording a bounce during summer, air travel numbers are slowing. | Source: TSA

Exactly a week later, the numbers fell to 841,806, and in the most recent Sunday, it was 807,695.

As summer comes to a close and demand for leisure travel wanes, the situation will get worse.

Bleak Month for Airlines

In the fall season, airlines mostly depend on domestic corporate travel to compensate for the reduced number of leisure travelers. This time around, airlines should not expect that scenario.

Recently, Bank of America stated that corporate demand for air travel is virtually non-existent and that it is unlikely to pick up in September.

Corporate air travel demand is not expected to pick up the slack following the leisure travel season. | Source: @AArriecheR/Twitter

Even worse for employees of airlines, autumn will mark the end of the payroll support offered under the Coronavirus Aid, Relief, and Economic Security (CARES) Act. American plans to cut 19,000 jobs in October. At United, 36,000 employees could be furloughed. Combined, American, Delta, and United intend to furlough close to 6,300 pilots.

Travelers to quiet locations will suffer, too. American has, for instance, signaled that it is removing services to 15 small- and medium-sized markets. United, on the other hand, plans to cancel flights whenever the load factor drops below a certain level.

Summer may have offered a slight reprieve for airlines, but it will get worse before it gets better. By dropping the change fees, the three airlines only signaled their desperation to see people fly, not a concrete strategy to deal with the coming storm.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the stocks mentioned.