- Bernstein downgraded Tesla’s stock to underperform.

- The Wall Street firm maintains a price target on the stock that implies a reckoning is coming.

- The analyst still warns investors that shorting TSLA is as dangerous as stepping in front of a freight train.

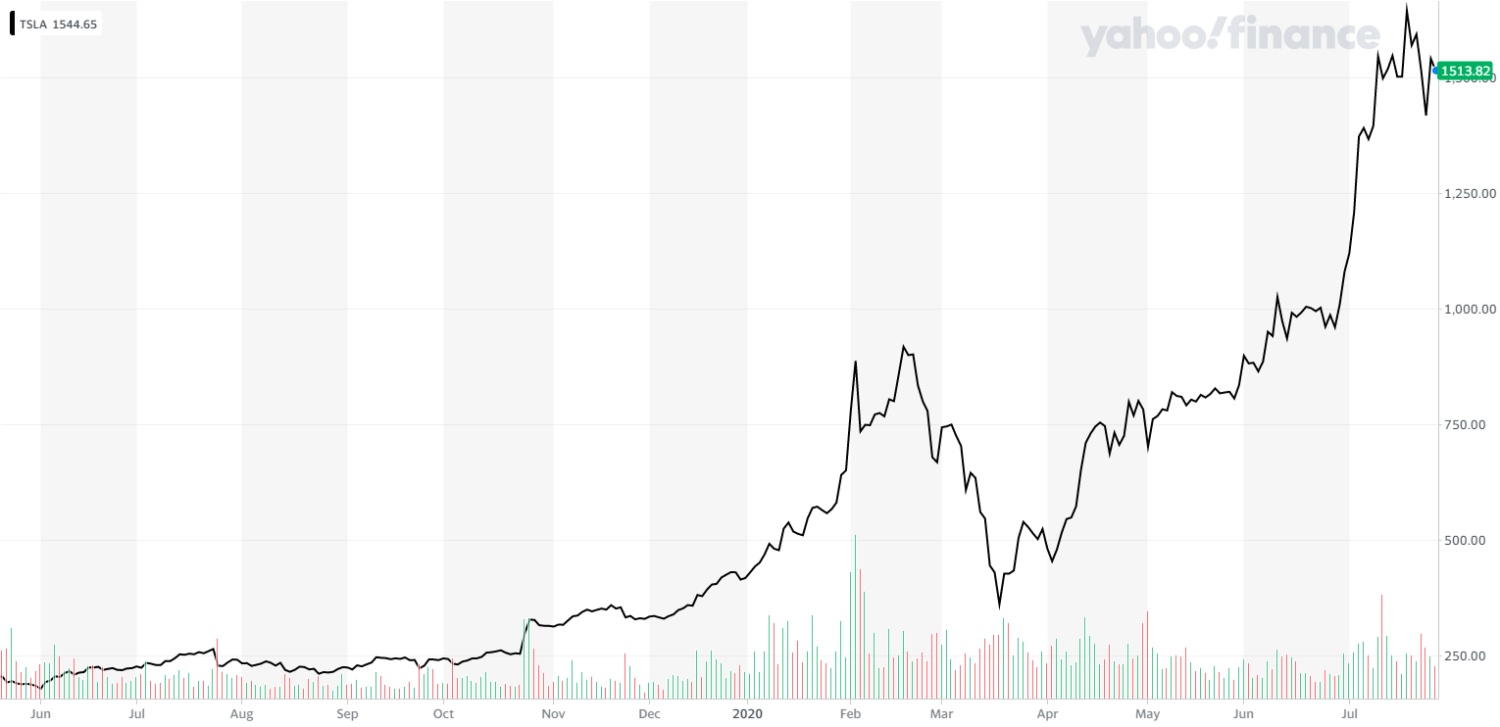

Even after careening from its all-time highs, Tesla stock (NASDAQ: TSLA) is still up more than 250% in 2020.

Bernstein analyst Toni Sacconaghi isn’t buying into the bullish narrative. The tech stock guru downgraded the electric carmaker’s stock from market perform to underperform.

TSLA traded below $250 a year ago. Today, it’s ranging above $1,500. | Source: Yahoo Finance

Although Bernstein remains optimistic about electric vehicle technology and believes Tesla boasts “structural advantages” over its competitors, Sacconaghi torched the stock’s valuation as “mind-boggling.”

The Wall Street firm maintains a $900 price target on TSLA. That would have been insanely bullish a year ago – when shares traded at $235.

Today, it implies Tesla stock is teed up to crash by 40%.

Bernstein warns investors: Do not short Tesla stock

Bernstein isn’t the only Wall Street firm slapping TSLA with a rating downgrade.

Last week, Tesla bull JMP Securities downgraded Tesla to market perform from market outperform.

Mid last month, Morgan Stanley and Goldman Sachs both downgraded the EV maker over valuation concerns. At the time, the stock was trading below $1,000 a share. It’s surged by over 50% since then.

Tesla is overpriced by around 25% relative to its average stock price target. | Source: Wall Street Journal

Wall Street’s average stock price target on Tesla is slightly above $1,200 – more than $300 below its current level. The consensus rating is hold, with more analysts recommending investors sell their shares than buy new ones.

This would seem like an invitation to short the stock. Despite its bearish price target, Bernstein warns investors this is a mistake.

The analyst believes the bullish momentum the stock is presently enjoying poses a risk for would-be Tesla short-sellers.

How risky? About as dangerous as stepping “in front of a barreling freight train”:

To be clear, we are not calling on investors to short Tesla’s stock, which – given recent price momentum – would probably be equivalent to us recommending investors to step in front of a barreling freight train.

Tesla is still a favorite among retail investors

Bernstein’s Tesla downgrade comes after the EV maker reported a fourth consecutive quarter of profits. This possibly opened the door for inclusion in the S&P 500 index.

The results earned Elon Musk compliments from one of the carmakers that Tesla’s market cap surpassed in January – Volkswagen.

Tesla has received a vote of confidence from none other than German carmaking giant Volkswagen. | Source: @ElectrekCo/Twitter

According to Volkswagen CEO Herbert Diess, Musk has achieved what many considered “impossible.”

Diess predicted that in under a decade, Tesla could topple Saudi Aramco and become the world’s most valuable publicly-traded company:

…in five to ten years the world’s most valuable company will be a mobility company — that can be called Tesla, Apple or Volkswagen.

Retail investors seem to agree.

Tesla has been the most popular stock on Robinhood over the past 30 days, with more than 210,000 new investors adding TSLA to their portfolios.

No other stock has surpassed 120,000.