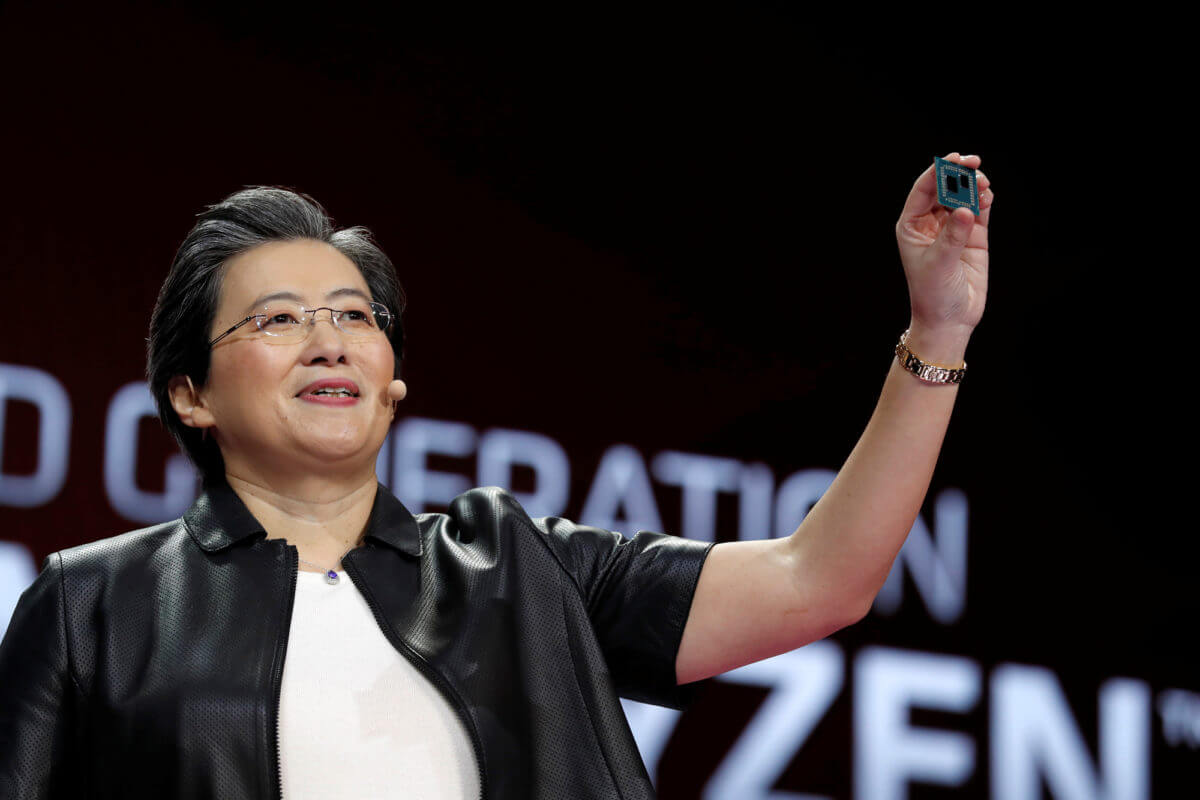

Lisa Su, president and CEO of AMD, launched the ridiculously successful 3rd generation Ryzen desktop processor, a true Intel challenger, earlier this year. | Source: REUTERS/Steve Marcus

- AMD stock (NASDAQ: AMD) is up 152% year-to-date and CEO Lisa Su sees stronger years ahead.

- The firm won contracts from both Xbox and PS5, re-establishing its dominance in the semiconductor industry.

- Better technology has allowed the company to position for an extended rally.

The semiconductor giant’s stock has increased by 152 percent year-to-date, re-establishing its dominance as a semiconductor powerhouse. Even after such a large rally in 2019, the company is expected to perform stronger in 2020.

Since Lisa Su took over AMD as CEO in 2015, the company saw a 1,000% increase in its stock price.

3 factors driving the AMD rally

AMD’s solid performance throughout 2019 and the past three years can mainly be attributed to three major factors: distribution of chips to major tech conglomerates and consoles, rising market share, and better technology.

This year, AMD’s introduction of the Zen 2 chip series was well received by both the public and experts. The firm revealed 7-nanometer processors that have the potential to outperform Intel’s 14-nanometer chips.

The deployment of higher performance computing chips positioned AMD to gradually take market share in the desktop, laptop, and server processor market in the upcoming years.

As said by Su, AMD expects its supply of chips to gaming consoles including the highly anticipated PS5 and Xbox Series X to contribute to the company’s growth in the upcoming year.

“2020 is going to be a big year for consoles,” said Su, emphasizing that the “best is yet to come” for AMD over the next five years.

AMD stock saw a stunning rally in 2019 with a 152% gain | Source: Yahoo Finance

Why investors raising targets for AMD

Despite being a dominant force in the semiconductor industry for decades, AMD still remains relatively small when compared with the likes of Intel and Nvidia.

As of December 25, the market valuation of AMD stands at $51.83 billion. That is a valuation three times smaller than that of Nvidia and less than one-fifth of Intel.

Investors are seeing the potential of AMD to expand over the long-term with strong technology and reliable distribution.

Outside of consumer hardware such as desktop, laptop, and consoles, the company is supplying some of the biggest technology conglomerates like Google, Microsoft, and Oracle for server processing.

Based on the firm’s strong fundamentals and a noticeable improvement in operations, Wedbush analyst Matt Bryson raised the target for the AMD stock to $51.

Winning Xbox and PS4 contracts from Microsoft and Sony cannot be underplayed

According to Patrick Moorhead at Moor Insights & Strategy, AMD securing contracts from Microsoft and Sony for both Xbox and PS4 shows more than merely a sales win.

Moorhead noted that the company was able to beat out the competition because of better technology in almost every area including IP, CPU, GPU, memory, video, audio, and I/O.

AMD won this business because they have the advanced IP, know-how, experience and commitment to make this happen. They have leading edge IP in CPU, GPU, memory, video, audio, and I/O. They also designed the first quad core, X86 SOC, and it’s not a giant leap to take this to eight cores.

The company also showed its willingness to take on additional flexibility and determination for long-term contracts by creating an independent team to deal with Microsoft and Sony.

This article was edited by Samburaj Das.