- Apple reportedly requests its suppliers to speed up production amid concerns of delay.

- Industry sources tell Nikkei that the September launch of the new iPhone line may be delayed.

- The company is working to minimize the delay and meet the deadlines.

Apple (NASDAQ:AAPL) has reportedly asked its suppliers to prevent delays in producing iPhones, according to Japanese publications. It shows the company’s confidence in a consumer demand recovery in the near-term.

The pandemic and the possibility of stricter lockdown measures have caused disruptions in supply chains worldwide.

There were concerns that semiconductor factories operating with limited capacity and materials may cause potential production delays.

But, Apple has asked its suppliers to speed up production in the coming weeks. Nikkei reports the new line of 5G iPhones faces a setback of up to two months.

Why Apple’s Aggressive Approach Is Positive

Historically, Apple often launched new versions of its flagship iPhone in September. A source previously told Nikkei that a months-long delay in mass production was likely. But, the likelihood of a significant delay in iPhone production is now low.

The source said:

What the progress looks like now is months of delay in terms of mass production, but Apple is doing everything it can to shorten the postponement. There’s a chance that the schedule could still be moved ahead.

Apple remains as one of the few stocks to come out of the pandemic unscathed.

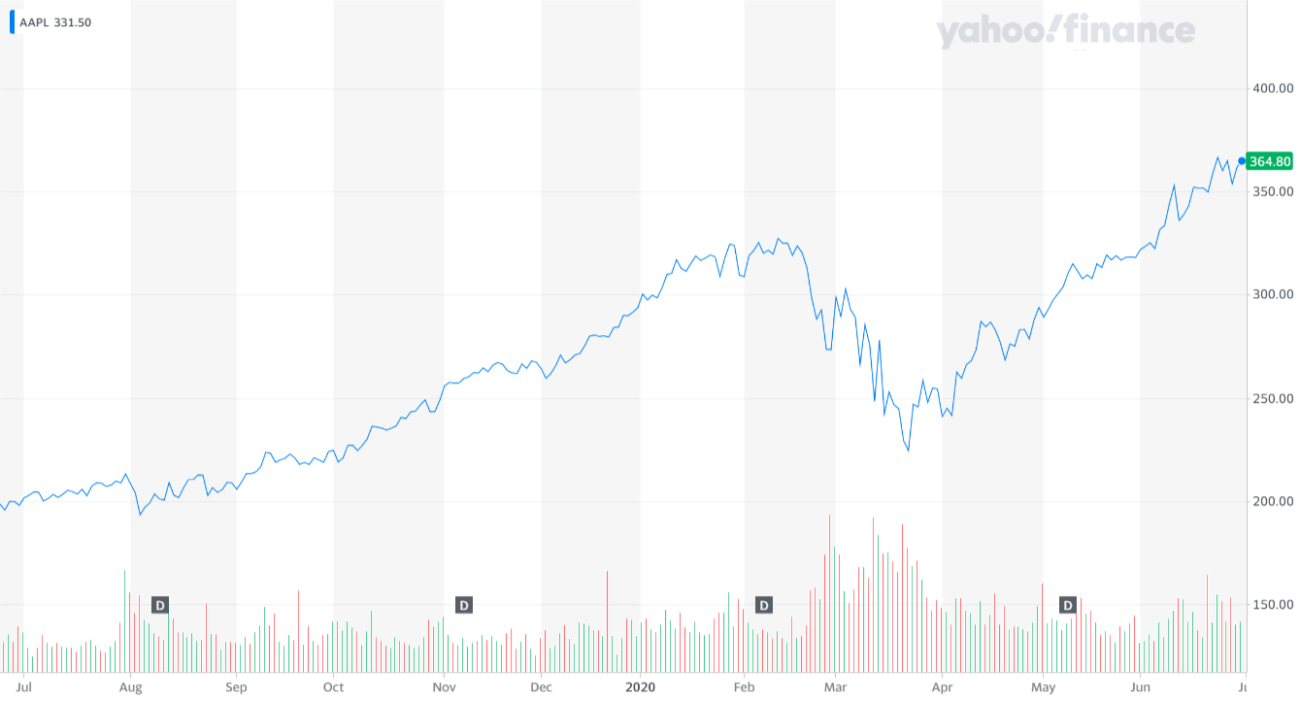

Apple’s stock is hovering around $364, having gained more than 12% from February. Since the U.S. stock market crash in late March, the stock rallied by 62.5% from $224 to $364.

Apple marches past the yearly high to set a new record. | Source: Yahoo Finance

The release of a new 5G iPhone in September could act as a fresh catalyst for Apple’s stock price.

A person familiar with Apple’s production said:

Some final iPhone assembly could be delayed to early October, and it wouldn’t be surprising if there are further delays.

Reasons for the production delay

As countries brace for a second wave of the pandemic, factories are struggling to stay open at normal capacity. The downturn coincides with a decline in the supply of crucial materials, including gold, used by semiconductor plants.

Morgan Stanley’s fixed-income division executive director Nicholas Thompson explains:

Gold bars and coins often trade at a slight premium over the spot price. That premium changes based on market conditions, and can increase when there are disruptions to the supply chain, refinery capacity or transportation availability. Increases in demand for physical bars and coins during times of increased uncertainty, combined with supply disruptions, can often push the cost to acquire these products higher, as seen during the COVID-19 crisis.

Apple’s request for faster production from its suppliers despite production challenges also suggests that it expects relatively high demand for iPhones.

During the first quarter of 2020, Apple saw an increase in sales of wearables. The AirPod line, in particular, saw a spike in demand, allowing the company to dominate the wearables market.

Apple’s performance over 23 years. | Source: Twitter

The consistent increase in the demand for Apple products in early 2020 might spill over to iPhones in the fourth quarter of the year.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com. The author holds no investment position in the above-mentioned securities.